The Unexpected Guest: Why Your Rental Property Needs a Safety Net (Landlord Insurance)

Imagine this: You’ve meticulously renovated a charming Victorian house, transforming it into a cozy haven for tenants. You’ve carefully screened applicants, ensuring responsible renters who will cherish your property. But life, as we know, often throws curveballs. A burst pipe, a devastating fire, a tenant’s careless actions – these unforeseen events can quickly turn your carefully laid plans into a financial nightmare.

This is where Landlord Insurance steps in, acting as your own personal guardian angel, shielding you from the unexpected and providing a much-needed safety net.

Landlord Insurance: More Than Just Bricks and Mortar

While many landlords may initially focus on the physical structure of their property, Landlord Insurance encompasses a much broader spectrum of risks. It’s a comprehensive policy designed to protect you from a variety of potential losses, including:

Property Damage:

- Fire and Smoke: Whether caused by faulty wiring, a careless tenant, or a natural disaster, fire can wreak havoc on your property. Landlord Insurance covers the costs of repairs or rebuilding, ensuring you can get your property back in rentable condition as quickly as possible.

- Water Damage: Leaky pipes, overflowing toilets, and even severe weather can cause significant water damage. Landlord Insurance helps cover the costs of repairs, mold remediation, and any necessary replacements.

- Vandalism and Theft: Unfortunately, vandalism and theft can occur, causing damage to your property and potentially deterring future tenants. Landlord Insurance provides coverage for these losses, allowing you to repair and restore your property.

Liability Protection:

- Tenant Injuries: Accidents happen. If a tenant is injured on your property due to negligence (such as a faulty staircase or a poorly maintained walkway), Landlord Insurance can help cover the costs of medical expenses and any resulting lawsuits.

- Third-Party Injuries: If someone other than a tenant is injured on your property (such as a visitor or a delivery driver), your insurance policy can provide coverage for their medical expenses and any legal claims.

Loss of Rent:

- Property Damage: If your property becomes uninhabitable due to a covered event (like a fire or a severe storm), Landlord Insurance can provide coverage for lost rental income while repairs are being made. This helps ensure that your cash flow remains stable during a challenging time.

- Eviction: While evictions are always a last resort, they can sometimes be necessary. Landlord Insurance can help cover legal costs associated with the eviction process.

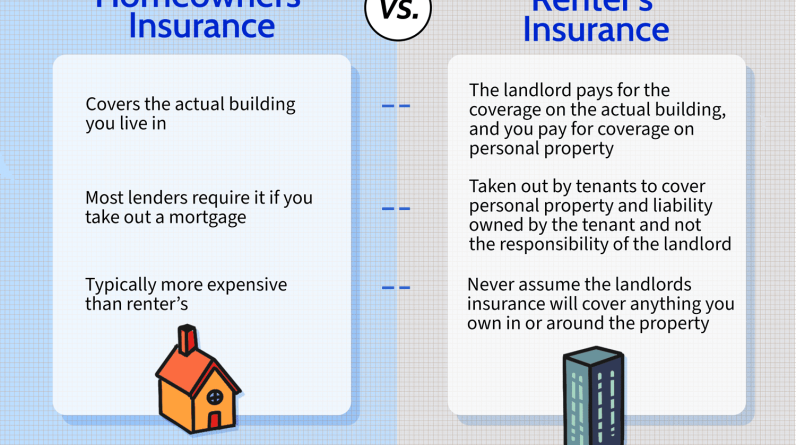

Landlord Insurance vs. Renter’s Insurance: A Complementary Duo

While Landlord Insurance protects your investment as the property owner, Renter’s Insurance plays a crucial role in safeguarding your tenant’s belongings and personal liability.

- Renter’s Insurance: This type of insurance primarily covers a tenant’s personal possessions within the rental unit. It also provides liability coverage if a tenant accidentally causes damage to the property or injures someone.

Think of it like this: Landlord Insurance is the sturdy foundation of your rental property, while Renter’s Insurance is the personalized protection each tenant needs for their own lives and belongings.

Why Both Are Essential

Encouraging your tenants to obtain Renter’s Insurance offers several benefits:

Reduced Liability for Landlords: By having their own insurance, tenants assume responsibility for any damage they cause to the property, significantly reducing your potential liability.

- Peace of Mind for Tenants: Renter’s Insurance provides tenants with valuable peace of mind, knowing their personal belongings are protected against theft, fire, and other unforeseen events.

- Improved Tenant-Landlord Relationships: Encouraging Renter’s Insurance fosters a sense of shared responsibility and can help build stronger, more positive relationships between landlords and tenants.

Making it Easy for Your Tenants

As a landlord, you can play an active role in encouraging your tenants to obtain Renter’s Insurance.

Provide Information: Include a clause in your lease agreement that encourages tenants to obtain Renter’s Insurance. You can also provide them with information on reputable insurance providers and answer any questions they may have.

- Offer Incentives: Consider offering a small discount on rent or a free month of a preferred amenity (such as laundry or parking) to tenants who can provide proof of Renter’s Insurance.

Landlord Insurance: An Investment in Your Future

Investing in Landlord Insurance is not just about protecting your property; it’s about safeguarding your financial future. It provides you with the peace of mind knowing that you are prepared for the unexpected, allowing you to focus on building a successful and rewarding rental property business.

Remember: Just like a seasoned sailor navigating choppy waters, a wise landlord anticipates potential challenges and prepares accordingly. Landlord Insurance is your compass, guiding you through the unforeseen storms and ensuring a smooth and successful journey in the world of rental property ownership.

Note: Since you haven’t provided the list, I’ll assume the second item is “Property Damage” as it’s a common concern for both landlords and renters.

Property Damage: A Shared Concern

Property damage can strike at any time, from minor mishaps to catastrophic events. Whether you’re a landlord or a renter, it’s a risk that deserves serious consideration. Let’s delve into how both landlord and renter’s insurance play crucial roles in mitigating the financial and emotional burdens associated with property damage.

Landlord Insurance: Your Shield Against Unexpected Costs

Imagine a burst pipe flooding the entire building, a fire tearing through the property, or a tenant’s negligence leading to significant structural damage. These scenarios can quickly turn into financial nightmares for landlords. This is where landlord insurance steps in as your reliable shield.

Property Coverage: Landlord insurance typically covers the structure of the building itself, including walls, floors, ceilings, and fixtures. This protection extends to damage caused by fire, storms, vandalism, and other covered perils.

- Liability Coverage: Perhaps the most crucial aspect, liability coverage protects you from lawsuits filed by tenants or third parties due to injuries or property damage occurring on the premises. For example, if a visitor slips and falls on icy steps, liability coverage can help cover medical expenses and legal costs.

- Loss of Rent: If a covered event renders the property uninhabitable, loss of rent coverage can compensate you for the income lost while repairs are underway. This helps ensure a steady cash flow despite unforeseen circumstances.

Renter’s Insurance: Protecting Your Belongings and Peace of Mind

While landlord insurance safeguards the property itself, renter’s insurance focuses on protecting your personal belongings. Think about your furniture, electronics, clothing, and other valuable possessions. Renter’s insurance provides a safety net in case of unforeseen events.

Personal Property Coverage: This is the cornerstone of renter’s insurance. It covers your belongings against various perils, including fire, theft, water damage, and even some natural disasters.

- Liability Coverage: Similar to landlord insurance, renter’s liability coverage protects you from lawsuits if someone is injured on your rented premises.

- Additional Living Expenses: If your rented unit becomes uninhabitable due to a covered event, this coverage helps cover the costs of temporary housing, meals, and other essential expenses while you find a new place to stay.

The Synergy of Protection: Why Both Are Essential

While landlord and renter’s insurance may seem to address separate concerns, they actually work together to create a comprehensive safety net for both parties.

Preventing Disputes: Clear coverage responsibilities outlined in both policies can minimize disputes between landlords and tenants in the event of property damage. For example, if a fire damages a tenant’s belongings, their renter’s insurance will cover the loss, while landlord insurance will cover the damage to the building itself.

- Promoting Responsible Behavior: Knowing they are protected by insurance can encourage both landlords and tenants to take better care of the property. Landlords are more likely to invest in proper maintenance and repairs, while tenants are more likely to be mindful of their actions and report any potential issues promptly.

- Peace of Mind: Perhaps the most valuable benefit of both insurances is the peace of mind they provide. Knowing you’re financially protected against unexpected events allows you to focus on more important aspects of your life, whether you’re a landlord managing your properties or a renter enjoying your home.

Property Damage: A Shared Responsibility

Property damage can be a stressful and costly experience. However, by understanding the role of both landlord and renter’s insurance, you can significantly reduce the financial and emotional impact. Remember, these policies are not just about protecting your investments; they’re about creating a safer and more secure living environment for everyone.

Disclaimer: This article is for informational purposes only and should not be construed as financial or legal advice. Please consult with qualified insurance professionals for personalized guidance on your specific needs.

I hope this article effectively explains the importance of both landlord and renter’s insurance in the context of property damage!